Thursday, December 12, 2024

The Impact of Medicare Advantage Plans on the EMS Industry

The Medicare Advantage program, introduced as part of the Medicare Modernization Act of 2003, offers an alternative to traditional Medicare by allowing beneficiaries to enroll in private health plans.

These plans, managed by private insurers but regulated by the federal government, often provide more comprehensive coverage than original Medicare, including benefits for dental, vision and prescription drugs.

However, their impact on various sectors of healthcare, particularly the ambulance industry, has become a matter of concern.

While Medicare Advantage (MA) plans have grown in popularity, their reimbursement practices, cost-containment strategies, and administrative processes have significantly influenced the operational and financial landscape of EMS services in the United States.

Medicare Advantage: An Overview

Medicare Advantage plans are designed to offer more flexibility and coverage than traditional Medicare, with an emphasis on managed care. Beneficiaries pay premiums to private insurers, and in exchange, they receive Medicare-covered services alongside additional benefits.

MA plans include health maintenance organizations (HMOs), preferred provider organizations (PPOs), and special needs plans (SNPs), which all operate under varying rules regarding coverage and care delivery.

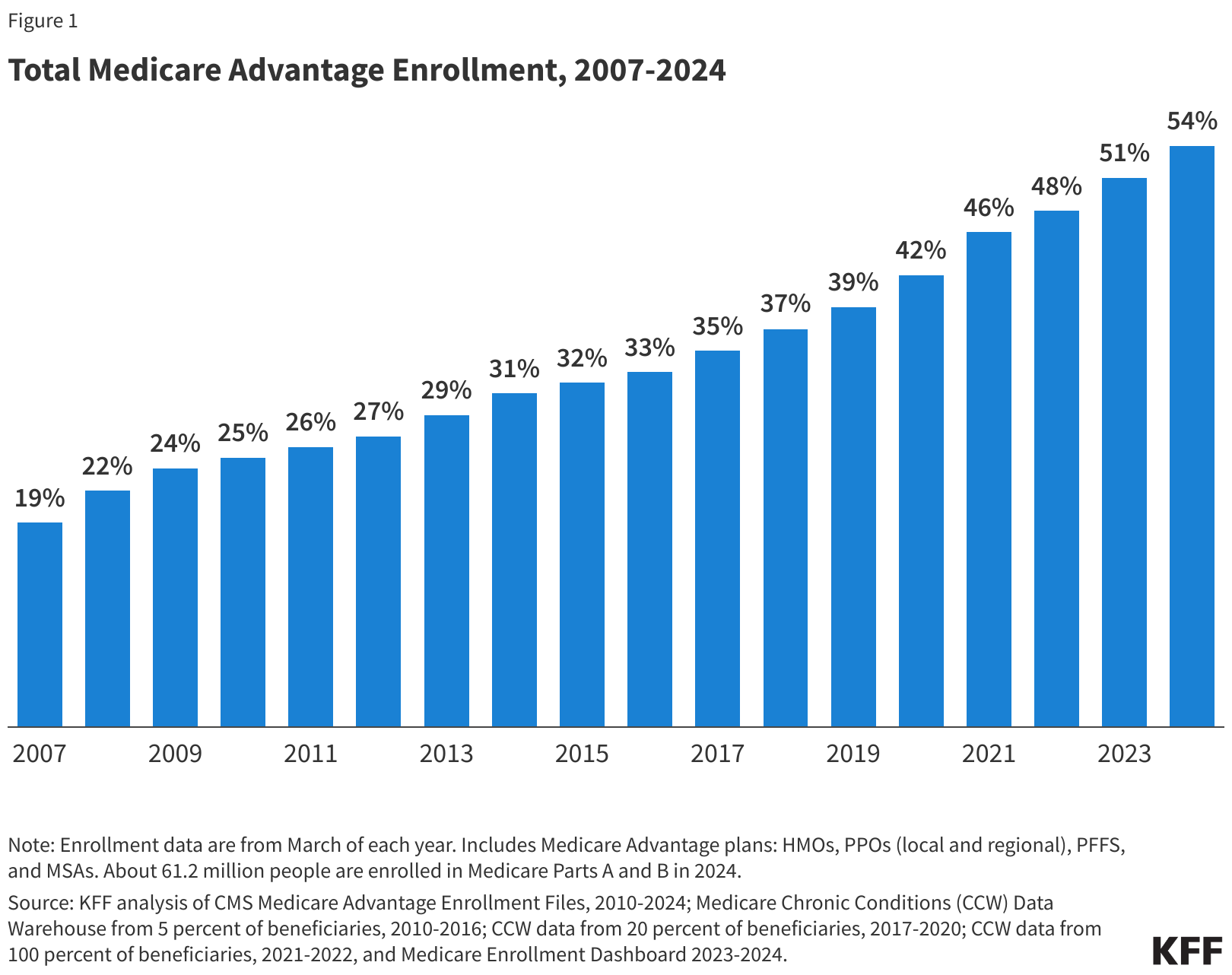

In 2024, 54% of total Medicare beneficiaries enrolled in a MA plan.1

These plans aim to control costs by focusing on network-based care, preventive services, and care coordination. However, this managed care structure introduces complexities in the way EMS services are reimbursed. EMS services, which are vital in emergencies, have found themselves at the intersection of these cost-containment strategies, which can complicate reimbursement and access to services.

Impact on EMS Reimbursement

One of the most significant ways in which Medicare Advantage plans affect the EMS industry is through reimbursement policies. Traditional Medicare provides clear guidelines for the reimbursement of ambulance services, primarily covering emergency transportation when deemed medically necessary.

Under original Medicare, reimbursement for EMS services is largely fee-for-service (FFS), meaning the service provider is paid a predetermined amount based on the level of service provided, regardless of which provider delivers that service.

Medicare Advantage plans, however, have more flexibility in setting reimbursement rates by modulating co-payments which lead to lower payments to providers and higher patient responsibility.

This has put significant financial pressure on ambulance companies, particularly those in rural and underserved areas, which rely heavily on Medicare reimbursements to sustain their operations.

Additionally, MA plans may require prior authorization for non-emergency ambulance transport, adding administrative burdens and delaying payments. In emergency situations, EMS services often provide services without knowing whether the transport will be covered by the MA plan.

When claims are denied or underpaid, EMS services must absorb the cost, leading to financial strain. Some MA plans apply stricter criteria for determining whether EMS services were “medically necessary,” which can result in claim denials.

As a result, EMS providers often face lengthy disputes with MA plans, increasing their administrative costs and complicating their operations.

This can leave both EMS providers and patients caught in a bureaucratic loop, where life-saving services may be contested after the fact.

Administrative and Operational Challenges

In addition to reimbursement issues, the managed care nature of Medicare Advantage introduces layers of complexity in how EMS services are coordinated and delivered.

Unlike traditional Medicare, where claims are submitted directly to the Centers for Medicare & Medicaid Services (CMS), MA plans have their own internal systems for claims processing and authorization requirements.

This increases the administrative burden on ambulance services, which must navigate multiple private insurance systems, each with its own rules and procedures.

Impact on Rural and Underserved Areas

Rural and underserved areas are disproportionately affected by the financial and operational challenges imposed by Medicare Advantage plans.

EMS services in these areas already face financial difficulties due to lower call volumes, higher operational costs, and greater distances between patients and hospitals.

The lower reimbursement rates and administrative hurdles associated with MA plans compound these challenges.

In rural regions, where ground transportation may take significantly longer due to distance, air ambulance services are often essential for saving lives during critical emergencies.

However, Medicare Advantage plans may limit coverage for air ambulance services, arguing that ground transport was sufficient.

This puts rural patients at risk, as delays in receiving care can have severe consequences in life-threatening situations.

For the air ambulance providers, this further complicates their financial sustainability, as they must absorb the high costs associated with air ambulance services when claims are denied or underpaid.

The Role of Legislation and Policy

Recognizing the challenges posed by Medicare Advantage plans, lawmakers and industry advocates have called for reforms to ensure fair reimbursement and access to EMS services.

Some proposed changes include standardized reimbursement rates for EMS services across both traditional Medicare and MA plans, as well as more transparent criteria for determining medical necessity. Advocates also argue for reducing the administrative burden on ambulance services by streamlining claims processing.

The Protecting Access to Ground Ambulance Medical Services Act of 2023 seeks to address some of these issues by ensuring that ambulance services receive adequate reimbursement under Medicare.

However, the legislation does not specifically address the unique challenges posed by MA plans. Additional legislative efforts may be needed to ensure that ambulance services, particularly in rural and underserved areas, are adequately compensated for the vital services they provide.

Conclusion

Medicare Advantage plans, while offering beneficiaries expanded coverage and lower premiums, have introduced significant financial and operational challenges for the EMS industry.

Lower reimbursement rates coupled with increased administrative burdens and stricter medical necessity criteria have placed considerable strain on EMS providers, particularly those serving rural and underserved communities.

As Medicare Advantage continues to grow in popularity, it is crucial that policymakers address these issues to ensure that EMS services can continue to provide life-saving care without being financially jeopardized.

Reforms are needed to balance the cost-containment goals of MA plans with the necessity of fair compensation for EMS providers, ensuring that all patients have access to timely and reliable emergency transportation.